loan is a type of financial instrument in which a lender gives money to a borrower, who then promises to pay it back over a predetermined amount of time, usually with interest. it can be used for a number of things, such as emergency financial support or home purchase. There are various lending options, each meeting a certain purpose.

The Types of Loan

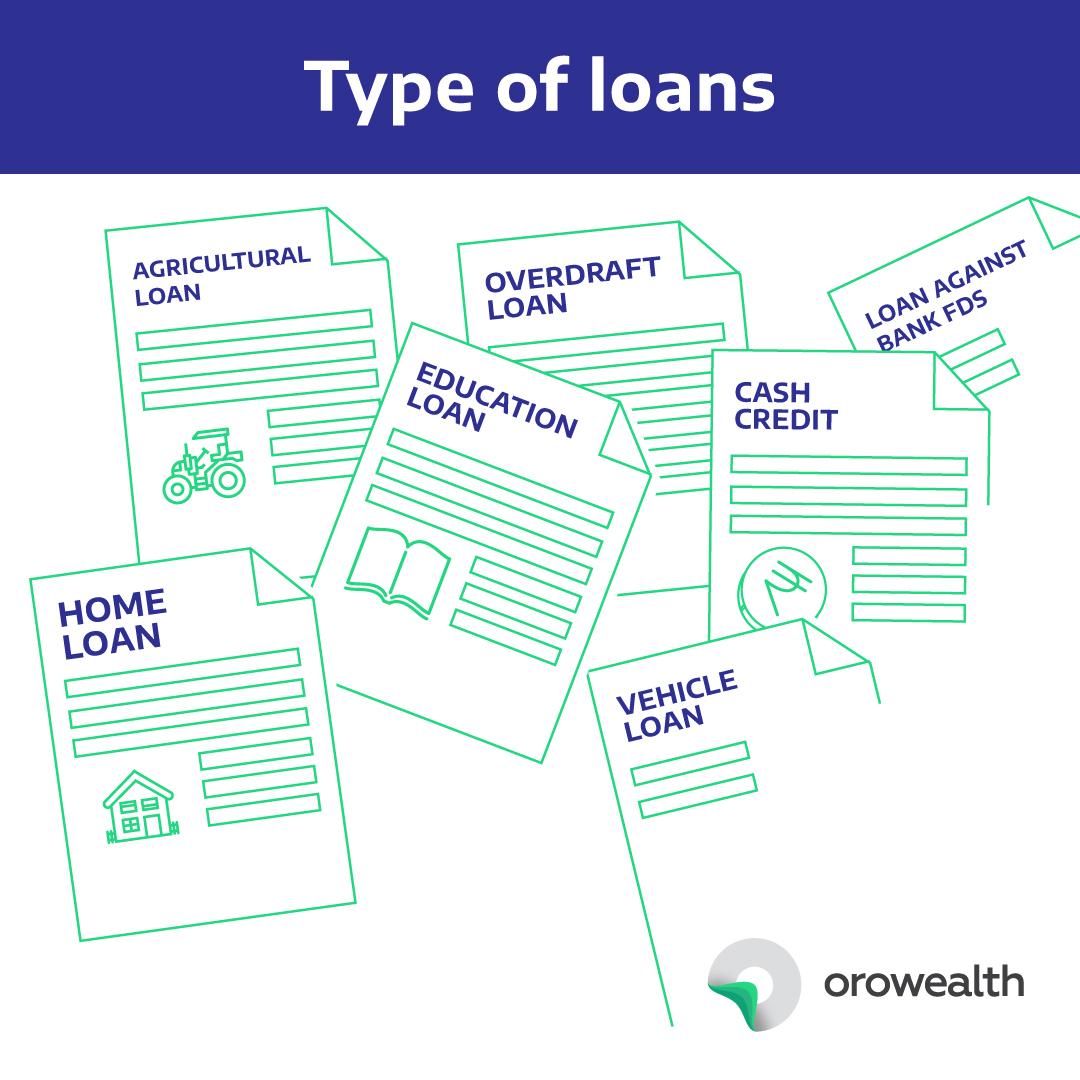

Making wise financial decisions requires an understanding of it and the various kinds of loans. Different loan types can be roughly categorized according to their origin, intended use, and payback schedule. What are different types of Loan and its attributes.

Definition of Loan Types

A definition of this is a classification of loans according to their terms and purposes. it can can be classified as unsecured (no collateral required) or secured (backed by collateral). Repayment schedules and interest rates—whether fixed or variable—are two further differences.

Which Four Types of Loans Are There?

Despite their diversity, loans can be broadly divided into four categories:

Personal Loans :

Unsecured loans taken out for individual needs, such as debt consolidation or unexpected medical costs.

Home Loans:

It is utilized to fund the acquisition of real estate. The monthly payments for a home loan can be estimated with the use of a loan home calculator.

Auto Loans:

These loans are used to pay for the purchase of automobiles. To calculate the payback schedule for a car loan, utilize a loan calculator.

Student loans:

It is intended to assist with the expense of education. These loans frequently include interest rates that are lower and alternatives for deferring repayment until after graduation.

Which Kind of Loan Offers Interest Subsidies?

The most prominent example of a loan type that offers interest subsidies is a student loan. Interest subsidies are available on a few government-backed student loans, including Subsidized Federal Student Loans. The total amount of student loans is decreased because the government pays the interest while the student is enrolled in classes.

Which Kind of Loans Offers Subsidies?

Subsidized student loans are the most popular sort of loans in a similar vein. By lowering the total interest the borrower must pay, these loans provide financial relief; in contrast, mortgages and vehicle loans seldom have this feature.

Calculators and Loans Applications:

It’s crucial to use a variety of tools, like a loans app or an online application process, to make the loans application process easier when taking out a loans. A loan home calculator, loan repayment calculator, or loans interest calculator can be used to estimate monthly payments in situations like as purchasing a house or an automobile. Users can use these calculators to see how much they will pay back over time, including interest. Investigate loans express services if you’re trying to find a loans that meets your demands; they can provide speedy approvals. On the other hand, if you’re in need of emergency cash, you might have to check into a loan emergency option, which offers instant cash support.

Additional Loan Factors

A loans approval possibilities can be affected by a number of factors, including your loan to value ratio (particularly for homes) and if the loan is secured by real estate. It’s also important to know if you want a low credit score loans, which can have special terms or guarantees, or a rapid cash loans, which typically has higher interest rates. It’s also necessary to take into account some loans expenses, such as origination costs and penalties for making late payments.

Definition and Significance of Loans

The definition of it goes beyond simple borrowing; it also includes the conditions, the borrower-lender relationship, and how the loans meets a particular financial need. Comprehensive awareness of loans is essential for financial well-being, regardless of whether you’re working with a finance company, obtaining a government loans plan, or even facing a special circumstance like managing your finances as a lone wolf.

In the current financial system, loans are essential since they give both individuals and corporations flexibility and support.

For More about Finance Pls Click the Below link:

https://getfreeloan.com/loan-calculator-and-application/

Pingback: Personal loan and use of personal loan calculator - GFT